Infrastructure costs and currency effects are squeezing Europe’s wind and solar developers amid an effort to meet challenging project deadlines, Bracewell LLP lawyers said at a media roundtable on Oct. 4

Although the EU’s RePowerEU initiative raises the target for the Renewable Energy Directive from 40% to 45% by 2030, developers on the ground are struggling to deliver projects at expected returns, according to the lawyers.

“Capital costs are much higher this year,” said Andrej Kormuth, a project finance expert and partner at Bracewell.

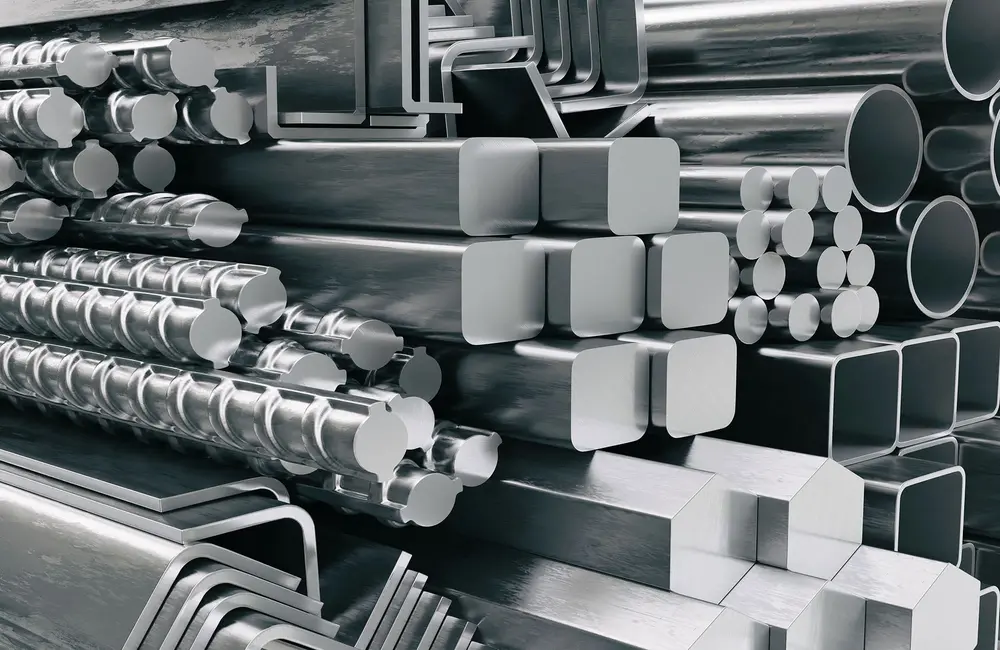

“EPC contractors are reporting steel and copper prices up 55%, aluminium up 50%, silicon for solar photovoltaic modules up 270% and logistics up 700%,” he said.

Internal rates of return falling below 10 percent meant renewable assets were becoming increasingly difficult to deliver in a number of jurisdictions, including the Middle East, Kormuth said.

“Developers who were jubilant [winning project tenders] a year ago now really are having a hard job to execute,” he said, adding that some are even considering whether to walk away from deals.

Offer deadlines

Several deals from last year had taken much longer to bank, and pressure had been mounting on developers to fill their offer deadlines or risk the cost of money rising, Kormuth said.

Those low-interest years leading into the post-COVID recovery and then the war in Ukraine are long gone, with “strong pressure” on developers to bank projects ahead of credit approval dates set by lending banks.

The pressure had filtered through to suppliers who were on cost pass-throughs that found their way into power purchase agreements, while many of the large projects that have signed Contracts for Difference now found "very unattractive" strike prices facing exorbitant market prices, he added.

That had been incentivising asset owners to delay entering into CFD commitments to take advantage of merchant returns, he said.

Currency movements were also pertinent in non-U.S. dollar jurisdictions, he said.

“If you are a bank that is lending in euros, you have a problem,” he said.

Although debt could be refinanced in a year or two from the start of operations, capital costs were crystallized “for up to three decades so that even if the price of commodities is predicted to fall, whoever does a deal [in the current environment] pays inalienably more,” he said.

US comparison

Increasing wholesale power prices mitigated some of these effects, Bracewell’s Ro Lazarovitch said.

“The renewable projects are banked for a given period; there is always that cushion in extending that period to factor in the escalation in the costs without changing the [awarded] tariff,” he said.

The cost of higher prices also benefited the prognosis for battery storage investments, Tom Swarbrick of the law firm said. From over a third of the market in Europe, interest had spread from the UK to Germany, Greece, and southern Europe, he said, with the only caveat to the future boom being the global shortage of lithium-ion.

Lazarovitch had highlighted the slow pace of enabling regulation in Europe, contrasted with the US’ Inflation Reduction Act that had a far more dynamic impact.

“We’ve seen an immediate uptick in clients accelerating projects that are in the range of incentives.