Electra Battery Metals aims to supply sustainable nickel sulfate from Canada to feed the North American battery value chain, which has recently gained heightened interest as battery makers and automakers seek alternative and domestic sources of metal.

Electra's Nickel Sulfate and Battery Precursor Plant Study

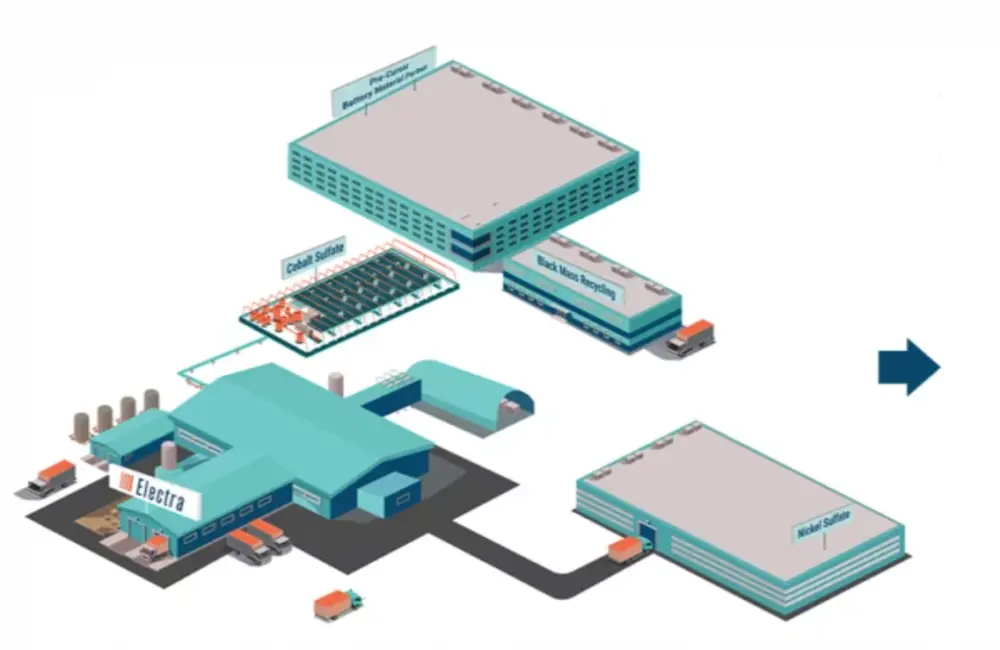

In Ontario, Canada, Electra is undertaking a $1 million study with the Government of Ontario, Glencore, and Talon Metals to investigate the economic feasibility of constructing nickel sulfate and battery precursor cathode-active materials (PCAM) plants adjacent to the cobalt sulfate and recycling operations it is planning.

“We certainly hope that [the nickel sulfate plant] can be a catalyst for faster development of nickel mining on the North American continent,” Electra Vice President of Commercial Operations Michael Insulan said in an interview with S&P Global Commodity Insights.

Insulan said his company could provide an immediate market for the material in Canada – one that is a direct line to batteries – and that it would give miners lower project capital expenditure, since they would not need to build their own processing capacity on the mine site, but instead ship an intermediate product to Electra.

“There’s not a lot of choice, if they want to go directly into the battery industry, but to ship it to China or Asia, so we see ourselves as a catalyst to accelerate the North American nickel mining sector,” he said.

“One of the booms for Electra and non-China or Indonesia nickel plays is that the auto companies and battery cell makers will go after alternative nickel sources,” he said.

Most nickel sulfate plants are located in Asia, as is the case with most battery metals, although there is a drive to create domestic capabilities in the West to decrease carbon footprints.

“Our project pipeline points to building towards commissioning this in 2025, and the idea is here, we use local raw material, so it’s not imported from Indonesia or anything like that,” Insulan said.

According to Electra estimates, Canadian nickel sulfate production would have a carbon footprint up to seven times lower than the conversion of Indonesian nickel deposits. Insulan also said that apart from the environmental issue, Indonesia was now also becoming more and more raw material resource nationalistic.

“There are a bunch of nickel sulfide deposits in North America that would supply the potential refinery and meet long-term needs in the region,” he said.

Demand from OEMs was also ample, which Electra anticipated to facilitate an accelerated North American nickel supply, leading to depressed long-term raw material costs through economies of scale.

Record-High Nickel Prices

Nickel has been in the spotlight in recent weeks as the London Metals Exchange suspended all trading at 0815 GMT on March 8 after the LME three-month spot nickel price hit an unprecedented $101,365/mt during early trading on the day, having closed March 7 at $48,078/mt.

When the suspension was implemented, it had fallen back to $80,000/mt, while trades made then March 8 were cancelled and a 5% daily limit on trading imposed once it resumed March 16.

The daily limit was raised to 8 percent on March 17 and then to 12 percent on March 18, with prices falling to the lower limit within moments of the opening on both days. The LME three-month last stood at $36,915/mt in early March 18.